|

| Paolo Savona |

Luckily, crisis was averted. A more conciliatory official was found for the Finance job, and Professor Savona accepted the lesser position of Minister for European Affairs. Savona was unacceptable to President Mattarella not only because of his views on the euro, but because he has warned repeatedly of the danger of a Europe dominated by Germany, calling the euro a “German cage” and accusing the Germans of seeking to dominate Europe by non-military means.

Savona has developed a plan, known as “Plan B,” for Italy to exit the euro. We have obtained a copy of Plan B in some detail: 80 slides. Professor Savona is a technocrat in the best sense of the word: this is a thoughtful, strategic, detailed, comprehensive plan, carefully documenting the harm that a fixed euro currency has wrought on Italy since 1999 and spelling out how a return to the lira (“nuova lira” or “new lira”) can be implemented. The full slide set is available here, but below is our summary of the key points and our commentary. While no official will yet admit it, Plan B is a viable policy option for the new government. (Note: translations are my own, please excuse inaccuracies and proficient Italian speakers are welcome to send corrections):

Savona has developed a plan, known as “Plan B,” for Italy to exit the euro. We have obtained a copy of Plan B in some detail: 80 slides. Professor Savona is a technocrat in the best sense of the word: this is a thoughtful, strategic, detailed, comprehensive plan, carefully documenting the harm that a fixed euro currency has wrought on Italy since 1999 and spelling out how a return to the lira (“nuova lira” or “new lira”) can be implemented. The full slide set is available here, but below is our summary of the key points and our commentary. While no official will yet admit it, Plan B is a viable policy option for the new government. (Note: translations are my own, please excuse inaccuracies and proficient Italian speakers are welcome to send corrections):

1. It will not be possible to keep secret for long preparations for euro-exit. The minister of finance, the prime minister, the governor of the central bank, and a few other key officials should meet secretly to discuss and prepare plans for exit.

2. Only when the plans are complete should they advise official bodies, European partners, the European Commission, and the European Central Bank. Their cooperation will be essential to minimize problems.

3. The public announcement should be made on a Friday after markets are closed, to take effect on Monday.

4. Capital controls will be necessary starting on D-Day, to limit the fall in the exchange rate.

5. On D-Day the new money will be introduced at parity with the euro. All salaries, prices, and other monetary values will convert at 1:1 to the new lira.

6. As soon as the announcement to leave the euro is made, the government should commission new banknotes and coins. Small transactions will be permitted to continue using the euro for a transition period.

7. We will re-denominate the national debt in the new currency, and make it clear that we wish to renegotiate the debt. This will be seen as a default, and ideally will be sufficient to reduce the debt to a level equivalent to 60% of GDP. [My note: Italian government debt stands at $2.3 trillion or 130% of Italian GDP]. The government should also make it clear that it intends to resume paying debt service as soon as practically possible.

8. The Bank of Italy must be ready to inject an enormous quality of liquidity in the banking system via quantitative easing. The monetary authorities should announce their readiness to recapitalize banks, as necessary.

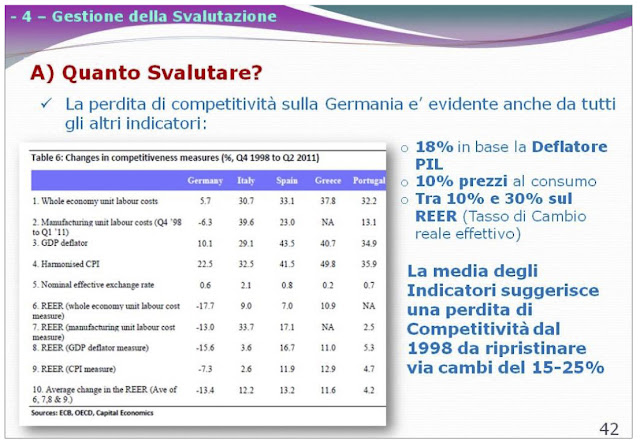

The Plan estimates that the new lira will need to be devalued between 15% and 25% to make the Italian economy competitive. It contains further detail on issues like the importance of maintaining friendly relations with European Union nations and governments, while aggressively seizing control of the Italian economy and monetary system and managing them in the interests of Italian economic growth. The plan reflects Professor Savona’s deep experience as a monetary economist: the list of organizations where he has worked or served on the board include several Italian banks and Italian industrial giants like Telecom Italia. He spent time in the US where he studied at MIT and worked at the Federal Reserve Board in Washington. He was Minister for Industry in the “technocratic” government of Carlo Ciampi in 1993-4 and a senior advisor on EU policy to one of Berlusconi’s governments 13 years ago.

Plan B in Context

The obvious crucial question is: will the new Italian government pursue Plan B? Both leading figures in the government, Luigi di Maio of the Five Star Movement and Matteo Salvini of the League, have made clear their dislike of the euro, and their contempt for Brussels. However, this is Plan B because there is also a Plan A, which is to renegotiate terms with Brussels that enable the Italian economy to begin to grow again within the euro. On his Facebook page, Professor Savona comments that as a believer in game theory, he is not going to comment before negotiations begin on whether he prefers Plan A, Plan B, or another plan entirely. The entire Cabinet will be involved in this decision, as well as other key players, such as Five Star founder Beppo Grillo.

Political leaders from Italy’s established major parties have been outspoken in denouncing the populists of the two new governing parties, telling the British press they are “beasts,” “inexperienced,” “terribly ignorant” and on a “suicide mission.” Five Star and the League dismiss their critics contemptuously. Displaying the populist spirit of revolt that helped Five Star come from birth in 2009 to a stunning victory as Italy’s largest party in the March election, Five Star official Roberta Lombardi said: “We won’t take lectures from Brussels. They should just shut up. If Europe fights us on our spending plans, we might be forced to let the people have their say in a referendum. I think that, given the chance, about 80% would vote to get rid of the euro.” The coalition’s plans also include a guaranteed “citizen’s income” and a promise to deport illegal migrants. But Italy’s dire economic situation is undoubtedly the biggest issue for Italians.

Christ Stopped at Eboli…But It’s Even Worse Today

Italy’s economic problems are more fundamental than simply being locked into the single currency. Like other advanced economies, Italy has been hit by a wave of imports from low-cost emerging economies. The textile and apparel industries in the north, once the envy of the world, have been decimated by cheap Asian imports. Manufacturing industries have also suffered. The manufacturing decline has hit southern Italy particularly hard. The south relied more than the north on low-skill employment to manufacture simpler products. For example, Italy was once a European leader in the manufacture of large domestic appliances or white goods. But production has fallen by nearly 50%, from 24 million units to around 13 million, as manufacturers moved production to cheaper regions in eastern Europe and elsewhere. Two years ago, the total population of southern Italy (known as the Mezzogiorno region) fell, for the first time since 1918, the year of the Spanish flu epidemic, as people flee the region in growing numbers and the people that stay, despite strong loyalty to the Catholic Church, choose to have fewer children. Poverty is on the rise in the Mezzogiorno. Italians now talk of the “desertification” of the region, as the population abandons the land that contains the beauties of ancient Pompeii and the Greek ruins of Sicily. One measure of the poverty of the Mezzogiorno is that Five Star’s victory was partly due to enthusiastic support in the region for the “citizen’s income”—which is pitched at the pitifully low level of $11,000 a year.

Figure 1 shows the decline in manufacturing production in Italy since 2000, down 19% while Germany’s has risen 30% in the same timeframe. Figure 2 shows the decline in GDP per capita, down 10.2% since 2007 (in constant 2011 dollars) to $34,655 in 2016 while Germany’s has risen 9.6% to $44,357. Germany has clearly gained from the move toward greater European unity, while Italy has lost out. We include Greece on our graphs because the lesson of Greece is highly relevant. Resolution of the Greek financial crisis was dominated by the German view that all debt must be repaid whatever the cost to the population of the debtor nation. Greece has now endured one of the longest recessions and steepest declines in living standards (down 25% since 2007) since the advent of modern economic record-keeping. Awareness of the fate of their neighbors across the Aegean was a factor in Italy’s vote for the populists in the March election.

|

| Figure 1: Germany gained manufacturing market share under the euro. Source: Eurostat |

The 1980s was the last decade when the Italian economy worked well. Those of us who visited Italy regularly then recall that every year prices rose. But every year, the value of the lira fell, keeping Italy highly competitive especially for buyers with dollars, pounds, or marks. Italy was an infuriating land of bureaucracy and inefficiency, yet Italian brands like Armani menswear, Gucci and Prada womenswear, Benetton casualwear, Indesit appliances, Alfa Romeo and Ferrari cars, and many lesser-known makers of machinery made Italy the envy of Europe. For anyone who understood the inflationary pressures built into the Italian economy and the price stabilization built into the German economy, it was obvious from day one that the euro would crucify the Italian economy.

Of course, Italy’s decline is due to much more than just the European Union. In a public letter sent in 2015 to former Greek finance minister Yanis Varoufakis, Professor Savona wrote: “Just as the dinosaurs died off because an asteroid slammed into the planet, so was dinosaur Europe struck by four different phenomena. Each was revolutionary when taken alone, but all together, they proved enough to cause an explosion, an implosion, paralysis: enlargement, globalization, the euro, the crisis.”

Our view is that a comprehensive solution is needed. The economy cannot be rebuilt without a plan to rebuild manufacturing. But the right place to start is with breaking the cage of the euro. Figure 4, also from the Savona presentation, shows the competitive losses Italy has suffered compared to Germany. Looking at these figures, we think the devaluation should be at least 25%, and the haircut on the public debt should be sufficient to open up space for Italian government spending on infrastructure, backed up by new measures to ensure most of that money finds its way to Italian businesses. The Italian textile and apparel industries can be rebuilt. It is also essential to hold prices in check, so devaluation of the new lira does not trigger inflation and throw away the benefits of the devaluation. Savona’s Plan B calls for targets and controls on inflation, without specifying how they would work. This is important. However, as Savona points out, spare capacity exists in the economy since GDP has fallen some 10% from its previous peak, making inflation less of a threat than it was in the 1970s and 1980s.

What is the European Union For?

Plan A may already be starting to work: German chancellor Angela Merkel is suddenly talking about more generous European policies on short-term lending to EU members in need. Germany will try to preserve the euro at all costs. The departure of Italy would be far more damaging than Greece would have been. There will be a lot of talk about the importance of “building the European project.” We will hear this from French president Macron as well as Merkel. But beneath the highflown rhetoric, the reality will be that German and French bankers will be begging the politicians to avoid a huge haircut to their billions of dollars of holdings of Italian government debt. Make no mistake: the single currency is a system by which Germany transfers wealth from the poor south (not just Italy, but all of the so-called PIGS: Portugal, Italy, Greece, and Spain), and uses German capital inflows to then lend money to the PIGS so they can continue to buy German goods. This is how Germany has managed to run one of the world’s largest trade surpluses. In this sense, Professor Savona was precisely right when he said the EU is a system by which Germany imposes its will on the rest of the EU (with the complicity of the French government).

This benighted system must be broken—for Germany’s sake as well as Italy’s. (And I might add, the US would be much happier if Germany’s currency revalued and its trade deficit shrunk.) Success and wealth arouse hostility, if it is earned at somebody else’s expense. The European Union was not established to enforce poverty and declining living standards on its southern members. That is an inadvertent byproduct. The Union was established because European political leaders were groping for a new vision to replace the left-right political dialogue that governed Europe in the century up to 1980. Instead of practical solutions, they offered a heavenly mirage, which has turned out to be a pillar of salt. The EU has failed to deliver on all the most logical things that unity should have delivered, such as common policies on foreign policy, defense, or immigration. Instead, it has fallen back on economic mismanagement as its core activity, and an endless stream of meaningless rhetoric which idea-poor politicians can use to distract and occasionally dazzle voters. The sooner Plan B can be implemented, the better for all EU members.

Professor Savona said it well himself: “During the process of political union, we took a wrong turn at one point. We failed to unite that which could be and needed to be united (such as defense). Instead, we united that which did not need to be united (for example, the size of vegetables). This is why in Europe today, it is not `more union’ that we need. What we need is to propose, discuss and design new `articles of confederation.’”

To American ears of course, mention of “articles of confederation” immediately brings to mind 1787. The men of 1787—James Madison, Alexander Hamilton, Thomas Jefferson, John Jay, Ben Franklin, among others—sought a union that would deliver immediate benefits to the citizens of the 13 states, not grandiloquent visions that would sound good at election time. Italy’s Plan B will provide an opportunity to those European leaders with the vision and the courage to change. Soon may it come.

Jeff Ferry is an economist and Research Director at the Coalition for a Prosperous America (CPA), an education and advocacy group supporting new trade policies to rebuild US manufacturing and restore economic growth. The views in this article are personal and do not represent the views of the CPA. His views on solutions for the US economy can be found at www.prosperousamerica.org.

No comments:

Post a Comment